The Impact of the Growth in E-Commerce on Organizational Culture and Leadership

18 June 2020

As e-commerce has continued to shape the retail environment, leaders and firms have interpreted the new environment in their own ways, devising strategies that work in response to the changes and for their unique market position. In light of the COVID-19 crisis and the key role that e-commerce has played during it, trends in this environment are of particular interest. To gain a better understanding of what retail e-commerce looks like today—specifically the culture and leadership in retail e-commerce—and what it will look like a few years from now, we spoke with a group of senior industry executives and asked them for their thoughts.

I. The E-Commerce Environment Today

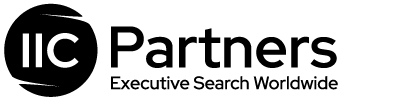

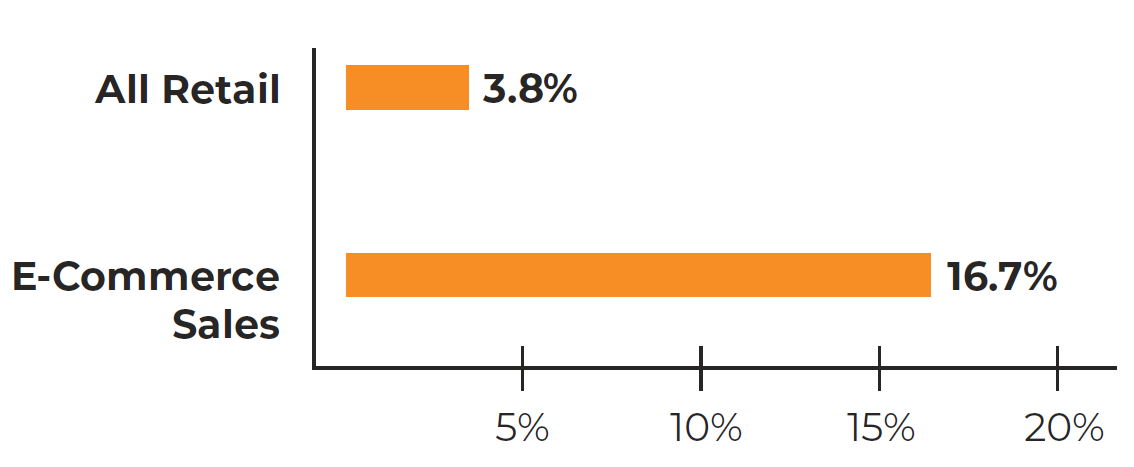

According to data from the US Census Bureau, e-commerce sales increased 16.7% between Q4 2018 and Q4 2019, compared to an increase of only 3.8% across all retail during the same period [1]. In 2014, e-commerce sales totaled just over $1.3 trillion, no small sum, but in 2019 they had grown to $3.5 trillion. This points to a trend that has continued at a rapid pace over the last decade, and over the last five years in particular, it has reshaped and redefined the way that retail firms think about their businesses and plan for the future. Progressing from a niche sales outlet into the sales outlet of preference for many customers, e-commerce is poised to continue to grow at a similar pace, exceeding $6.5 trillion in worldwide sales by 2023 [2].

INCREASE IN US SALES (Q4 2018–Q4 2019)

WORLDWIDE E-COMMERCE SALES

Weighing in on the effect of this trend on his firm, Truffaut CEO Gilles Mollard says that it is necessary to “evolve the ways we do business.” He cites several ways that e-commerce businesses can do so, but he starts by explaining the value of well-functioning e-commerce platforms. Following what he calls “a seamless purchasing experience,” he has spearheaded the development of e-commerce tools that follow a straight path from the product pages to the checkout, defining clear steps that make it easy for customers to shop, emphasizing the customer experience in the same way that retailers would have in the past.

Mr. Mollard also mentions home delivery as a possible value-add for retail e-commerce businesses, stating that he tries to create “responses tailored to increasingly ubiquitous clients.” Rather than eliminating the work inherent to retail, e-commerce creates opportunities for more work, by implementing the right tools to satisfy people’s needs even more fully than retail would have otherwise.

In Mr. Mollard’s view, a hybrid strategy is the ideal. He describes “in-store activities” that offer customer experiences that encourage them to engage with both sales channels, viewing e-commerce more as a tool of convenience and enhancement than as the sole retail platform. This approach, it seems, is in alignment with e-commerce giant Amazon’s, which spent $13.4 billion to purchase the brick-and-mortar grocery chain WholeFoods in June 2017 [3]. While there are certainly those who believe that either e-commerce will remain dominant or brick-and-mortar will experience a resurgence, a combination strategy may be the wise choice.

Mr. David Ennes, SVP of Asia and Global Head of Travel Retail at Remy Cointreau, on the other hand, says that as far as online sales go, his firm has operated on a limited basis, bucking the trend in a sense. In other countries across Asia, both strict regulations and e-commerce limitations have kept Remy Cointreau offline. Despite the worldwide clamor for more e-commerce in recent years, Mr. Ennes explains, “[W]e are just starting some experiments like in Singapore.”

Mr. Ennes notes that only five years ago, online sales for Remy Cointreau were non-existent in China as well, accounting for none of the firm’s business there. The speed of this shift online matches up with what we know of online infrastructure, which is much easier to develop than physical supply chains, meaning that there is a much lower barrier to entry for retail e-commerce than for brick-and-mortar retail because of the storefront rental costs that retail businesses need to cover upfront.

Mr. Ennes states that compared to classic sales channels, the online sales channel in China has driven substantial profits. This too aligns with what we know of online infrastructure, which is significantly less expensive than physical supply chains and brick-and-mortar locations, which carry overhead that can quickly come to bear on many industries. Covering rent, utilities, sales staff, and other payments, brick-and-mortar stores are at a natural disadvantage, which explains at least in part their lag behind e-commerce over the last five years.

One anonymous professional at a global luxury retailer working in e-commerce agrees with Mr. Mollard’s assessment that a hybrid strategy is most viable, saying that she has seen significant growth around omnichannel and retail e-commerce in conjunction with brick-and-mortar stores. One strategy that she describes seems especially enticing because of the convenience that it offers customers: “making reservations online for products only available in store and have the ability to reserve the product for 72 hours for you.” This, of course, makes it possible for brick-and-mortar stores to offer a speed that e-commerce largely does not because pick-up could be immediate.

The anonymous professional says that her firm’s website has turned into a sort of online catalog where customers can browse the products that are available to them, including the products that are available to them via pick-up in the physical location. While this arrangement may not be universal, it is typical for many retailers that were in operation prior to the emergence of e-commerce, including Tesco and IKEA, retailers from the UK and Sweden respectively that have built successful hybrid strategies during the e-commerce shift [4] [5]. Maplin, meanwhile, moved their operation completely online, though their IT Director described it differently: “We haven’t changed Maplin, we’ve changed the model to make it more efficient and not have that massive cost base, which included 217 stores” [6].

While the changes of e-commerce may seem most striking when put into statistics and interpreted as changes in market share, their effects are also causing executives, leaders, and other professionals to reconsider their philosophies and strategies as they work with one another. The reality of our technological world is seeping into and transforming the mindsets and beliefs that these executives and leaders use to make decisions about their businesses. Let’s examine what that looks like.

II. Changing Cultures

How has the rise of the e-commerce environment changed mindsets, philosophies, and strategies among retail professionals? Deloitte conducted one study that concluded 94% of executives and 88% of employees believe a distinct workplace culture is important to business success, which means it should follow that retail e-commerce executives and employees are placing weight on the culture that they are building together [7]. While we cannot expect all firms and all professionals to respond to the realities of the e-commerce environment identically, it does seem reasonable to assume that we can identify commonalities between cultures.

It would make sense, for example, that cultures among retail e-commerce professionals would account for the nature of the competition that firms are up against today. Facing agile, disruptive new firms all the time, even the preeminent firms cannot assume that they will be able to hold their market position by continuing to do what has worked for them in the past—an assumption that would have been somewhat safer before the e-commerce shift started to take place. It would also make sense that firms would adapt their sales and marketing efforts to big data, seeing the results that others have driven for themselves by doing so.

E-COMMERCE CULTURAL CHANGES

Just as different firms will focus on different products and different audiences, they also tend to focus on different areas of culture, considering their unique status in the market given their previous business infrastructure and the product that they are offering to their customers. Take Remy Cointreau’s spirit business once again: as a firm, they need to focus on regulatory issues, but for another firm, one selling a product for which regulation is not a major factor limiting sales, the same focus would not be helpful.

According to Thomas Bucaille, SVP of HR and CSR at Petit Bateau, speed and flexibility are more important than ever before. While speed may have helped growth in times past, it is today a prerequisite for firms hoping to remain competitive in their respective markets. In the same way, adaptability may have afforded firms an edge in the past, but because of the speed at which market can change via e-commerce, adaptability must come built into a firm’s culture in order for them to avoid disaster. Toward this end, Mr. Bucaille says that he and his team “try to set up more collaborative and fluid ways of working, beyond classic project teams.”

Mr. Bucaille emphasizes that because his firm is working at faster speeds, decision-making must be quicker as well. One can imagine how bottlenecks could occur in a retail e-commerce business if certain teams were working much more quickly than others—and relying on their slower counterparts to make decisions and grant approval for processes that either help or hinder the businesses depending on how efficiently they can function. A culture of timeliness can mean the difference between sales lost and loyalty won for retail e-commerce firms.

Weighing risk and education, Mr. Bucaille says that a firm must be able to learn in order to be effective. He quotes the age-old mantra “try often, fail fast, learn from it,” but he recommends taking this a step further, making it systematic to the organization so that employees view failure (as long as education accompanies it) as a regular part of doing business. Of course, he also points out the key to making this systematic failure possible: “availability of quality data.”

Kevin Kelly, a senior leader in retail e-commerce, looks more to the past to describe the realities of the current e-commerce culture, reflecting on the way that many firms stumbled when e-commerce started to appear. He says that “a lot of traditionalists saw it as a competitor and did not embrace it.” Instead of viewing e-commerce as an opportunity for retail as a whole, some firms viewed it as an existential threat—and built a culture around a dated idea.

Highlighting his firm’s growth in Canada over the last year, Mr. Kelly believes that his firm has found success in e-commerce by accepting that it was a positive development—not something that they needed to fight but something that they needed to integrate and leverage for themselves. He says that year over year, his firm has posted double-digit growth in the country, a significant increase for an already-successful business—and one that resulted from a culture that is unwavering in its positivity about e-commerce.

Meanwhile, Chief E-Commerce and Customer Experience Officer at a Canadian based clothing brand, James Connell expresses pride in his firm’s developing data-driven culture, saying that “consumer insights derived through the combined e-commerce and marketing programs are informing the organization about consumer behaviour and habits rather than e-commerce being about sales, and marketing being a service to the organization.” This is a viewpoint that gets at the heart of many retail e-commerce cultures, using the availability of big data to better serve customers and generate business. He describes a culture that revolves around seamless product and data movement from one department to the next.

Data, of course, has taken on a new importance as it has become possible for firms to collect and analyze it in larger quantities. As Andrew McAfee, the Co-Director of the MIT Initiative on the Digital Economy, said, “The world is one big data problem.” This quote encapsulates the optimism that many firms and professionals have about the power of data—seeing it as a tool of almost endless possibility. As Mr. Connell puts it, “We educate the entire business about insights gained from customer interaction data, to help identify their wants and desires to gain maximum value and influence decision making across the organization.”

Mr. Mollard of Truffaut, on the other hand, points out the longevity of his firm –and connects it to a culture that has already overcome many hurdles during its history. He says, “When a firm (i.e. Truffaut) celebrates 195 years of operations, its culture has already withstood many upheavals and it is not directly impacted by e-commerce: clients are still clients!” For firms like Truffaut, e-commerce is not an existential threat, but even Mr. Mollard concedes that “the entity can and must get a firm grip on digital tools (in-house and with clients) to take positive action in terms of appropriation and diffusion of a culture in-house.” At 195 years of age, Truffaut is an exceptional firm that is able to view e-commerce as a complement to an overall business strategy that has already been working over a sustained period of time.

Because there are many perspectives to take of the changes that e-commerce has ushered into retail, there are also many variables that a retail e-commerce firm can focus on as they are building their culture. Some focus on speed and flexibility, some focus on data, and some have focused on e-commerce as a general opportunity, opening their businesses to new customers and empowering them to grow. Others, however, have accepted their role as out-liers, seeing that e-commerce has changed the retail landscape but recognizing that because of the strength of their brand (like Truffaut), they do not need to overhaul their entire strategy.

As Richard Branson, the famed CEO of Virgin said, “Create the kind of workplace and company culture that will attract great talent. If you hire brilliant people, they will make work feel more like play.” This is, in their varying ways, what these retail e-commerce leaders are doing—creating cultures founded in the talent that they want to attract and the work that they know they need to do in order to thrive.

III. Changing Leadership

Although we may view leadership primarily in terms of values, it is also a matter of circumstance. Leaders make decisions both on the principles that they stand for and on the pressures that their environments put on them. There are as many leadership styles as there are leaders, but it is still useful to examine how retail e-commerce leaders believe the growth in e-commerce has impacted their personal leadership styles and encouraged or inspired them to think and behave in certain ways.

Mr. Mollard of Truffaut, when asked if the changing route to market has affected his style of leadership, responds, “I don’t think so. The corporate raison d’être, ambition, values, and project will undoubtedly evolve, but I don’t see any cause and effect between the rise of e-commerce and any leadership style.” For him, like Truffaut itself, leadership is an absolute concept, one defined by people rather than technology.

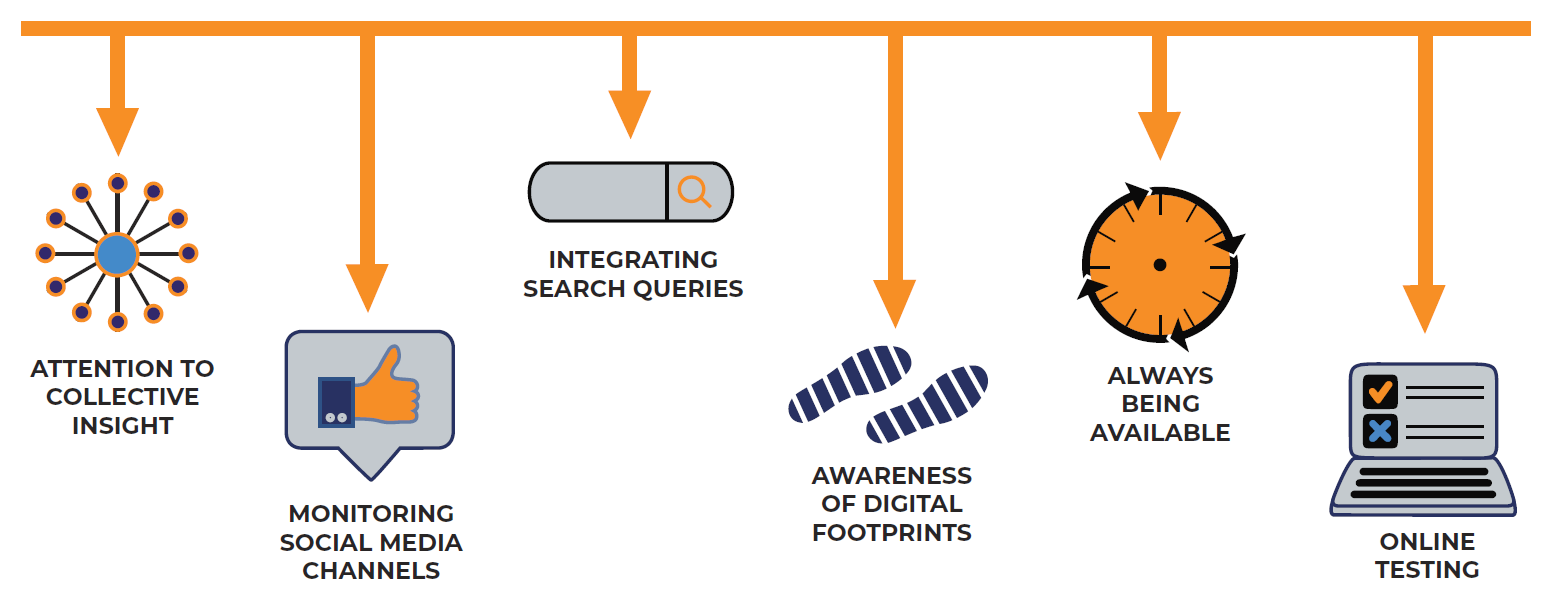

CHANGING E-COMMERCE LEADERSHIP TRENDS

Explaining further, Mr. Mollard explains his observation that growth in e-commerce has coincided with new viewpoints and beliefs among young people about their professional lives. Growing up on the internet, the younger generations think about their personal and professional lives in different terms than the generations that have come before them, and by pointing this out, Mr. Mollard says that leaders must take responsibility for it, putting their younger employees at ease so that they are able to thrive in the workplace.

Mark Laxton, the Commercial Director at Evans Cycles, sees a definitive change in leadership styles due to growth in e-commerce. He believes that because of e-commerce, his business has experienced a flattening in leadership, corresponding to the higher levels of accountability that all employees must take—as well as the new capabilities that are available to them because they are operating online. Rather than relying on a strictly top-down hierarchy, employees at all “levels” of the business are making decisions and taking action in order to serve the customers, a major shift away from the traditional business structure.

Drawing a connection between leadership and insight, Mr. Laxton lists a number of areas in which firms can benefit from fostering collaboration and empowering all employees to embrace their roles as leaders. Specifically, he says that buying, marketing, and e-commerce can all benefit from “collective insight,” pointing to a leadership style in which multiple people offer their opinions and submit their viewpoints as a means of arriving at the right answer.

Mr. Laxton also says an important aspect of leadership for him is “thinking more about brand relationships.” Because stronger relationships will lead to stronger production and more consistent service, he sees this as primary to the leader’s duties, striving to cultivate strong bonds with brands, even winning brand exclusivity as a result of these efforts.

Mr. Kelly, the senior retail e-commerce professional, explains leadership in terms of mindset and philosophy. He begins by saying that “the leader must be adaptable to change.” This advice is similar to the advice that he offered regarding culture, and he goes on to specify that “the leader must be so number driven, across social and technological, all marketing channels and be on the pulse with the social aspect for both the positive or negative side.” Put another way, the leader must be both aware and responsive, picking up on any factors that could affect the business and then devising an appropriate strategy to address those factors.

Linking this leadership mindset with social media, Mr. Kelly emphasizes the newest and most cutting-edge sales channels, opining that leaders should also understand search and how to leverage it for their businesses. He seems plugged into the many methods that the newest firms are using to build their audiences and intent on maintaining dominance within them—equating leadership with innovation and seeing the leader as someone who would naturally seek out opportunities for disruption, to adopt them before they become an issue.

Mr. Kelly emphasizes the central motivator for leaders today: conversions. He again draws a parallel between the philosophical side of leadership and the technical side of it, saying that a leader should be able to “[get] people to array the offerings and convert, what that means to get items in their basket and to buy.” In this sense, leadership in e-commerce is akin to leadership in traditional sales, guiding customers to a desired action in order to generate revenue.

Mr. Connell, even more so than Mr. Kelly, expresses certainty that growth in e-commerce has altered leadership styles, pointing out the importance that many professionals and leaders are now placing on testing. He explains that by testing in the digital space, he and his firm have been able to take what they have learned from their testing and apply it in the real world, making better-informed decisions more quickly instead of hazarding guesses when they make real-world decisions and pivoting later. Using e-commerce this way, he is pioneering a more cost-effective strategy for learning about customers and gleaning insights that he can then apply to his business at large.

Suggesting that “consumer data is different in this space,” Mr. Connell says that because it is possible to track a digital footprint, it is possible to know customers more completely, understand their holistic needs and what they want. Doing this, he leads his teams by delegating work to them based on the insights that they are constantly gleaning from their testing and tracking. This makes the projects that they take on more precise and directed.

To bring this process more to life for his employees, Mr. Connell says that he is always trying to “[develop] visual management.” Showing his teams the progress that they are making and pointing out the impact their progress has on the business, he keeps people engaged and working hard, encouraging them to see themselves as parts of a whole while also seeing themselves as taking ownership of complete projects and driving specific results, as he says, “keep building momentum, engagement and team work across the organization.”

An anonymous retail e-commerce professional points out that because of growth in e-commerce, retail is always available to customers. When someone wants to purchase something, they can decide that they want to do so in the middle of the night and The anonymous professional describes this reality as a sort of double-edged sword. While it is clearly more convenient for customers that their preferred retailers are only a few clicks or a few swipes away from them at any time, this also means that the service (and the people who oversee it) must be available at any time as well. There is a downside to this because of the immense work that it puts on leaders. As the anonymous professional says, “[leaders] need to be on the pulse point looking at different things and technologies and always available.” In an environment where change is constant and unceasing, leaders must be able to res- pond to it constantly—and unceasingly.

The anonymous professional also offers some sound advice for dealing with this potential downpour of service requests and environmental shifts: “You need to address points diligently and efficiently and make sure changes are done quickly and adapt to a different time and technology.” Thinking on one’s toes, leaders in e-commerce today must be ready to shift to new platforms and tools just as the retails who have become them have done (or failed to do and suffered the consequences).

Leadership, like culture, is different for everyone and from one moment to the next. Just as Truffaut is the exception for its culture, which has thrived for nearly two centuries, its leadership requirements are also the exception because they have remained relatively unchanged. Other firms, executives, and professionals have witnessed a flattening effect in their leadership, the old and established hierarchies fading away in favor of a structure in which all employees must take ownership of the tasks in front of them. For others, leadership comes down to a set of specific processes, relating to technologies such as social media and search —and how to make the most of them for the sake of the business.

During the COVID-19 era, leadership has, as we all know, taken on a new meaning. Because of the importance of every decision that leaders make during the crisis and the ever-changing circumstances with which all firms must contend, leadership can mean the difference between successfully navigating the crisis and not. The firms equipped with effective leaders, which is to say leaders who are following intelligent business processes, will be able to emerge from the crisis either unscathed or perhaps even stronger than they were going into it.

IV. Looking to the Future

As we have seen, misconceptions about the rise of e-commerce were common twenty years ago, and even five years ago, few analysts could have predicted the downfall of Sears, a firm that had been in operation since 1892. Since predictions seem more accurate if we look a shorter distance into the future, we have asked our experts to consider the key developments in e-commerce only over the next 2-3 years.

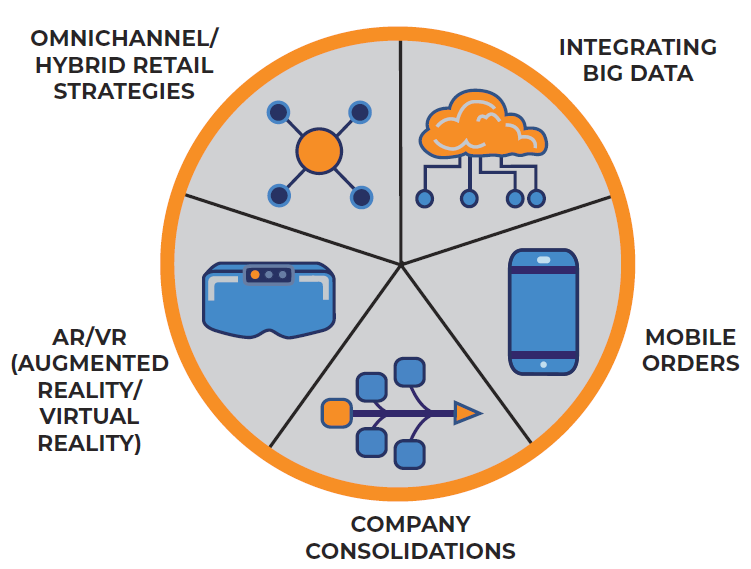

In response, Mr. Bucaille says that he believes investments will remain high. He says, “Omnichannel will become the norm,” which means that for firms that have already cultivated a hybrid retail strategy, their processes and systems will already be ahead of the curve, saving them the time and resources that others will need to quickly expend in an attempt to catch up with them.

Mr. Bucaille also says “Client and data will be more and more at the center of the organization.” This too would line up with the movement that we have seen over the last five years, the rise of big data taking retail by storm and its integration into the market showing no signs of slowing down. He takes his prediction a step further, though, saying that because of the standards that Amazon has trained consumers to expect, all other retail firms will need to adhere to the same standards or risk alienating their customers.

Mr. Mollard, meanwhile, focuses more on the steps that he will need to take to keep his employees up to date, “[equipping them] with digital tools to remain on a par with their clients’ level of information.”

Mr. Mollard also says he is interested in taking into account the goals of young professionals, recognizing that they likely differ from those of previous generations. Stating this, he is setting himself apart from firms that assume young professionals will, rather than look for opportunities elsewhere, acquiesce to established ways of doing business. Looking to make new talent comfortable, he is open to factoring their aspirations into the business over the coming years.

FUTURE E-COMMERCE TRENDS

Mr. Laxton, over the next 2–3 years, believes that fewer retailers are likely to survive in their current form, and he foresees an increase in consolidations. Referring to his market specifically, he says that “pure play retailers” are “retailers struggling to give consumers enough touch points for bikes.” He also notes that distribution and marketing costs have become unsustainable for many retailers, who are under an enormous pressure to continue to spend to keep up with their competitors but unable to justify doing so in the long term.

Also planning for the years ahead, Mr. Laxton says that he will continue to build brand relationships, collaborating with the right firms in order to satisfy his customers’ needs. He aims to cultivate strong connections so that he can continue to expand his retail e-commerce business, stating the need to “have scale to become profitable.”

An anonymous retail e-commerce professional says that looking around at the e-commerce landscape, what stands out most to her is how much more frequently consumers are using their mobile devices to place their orders. She says that while firms have made efforts to make their platforms mobile-friendly, she thinks that this will take on an even greater importance. Much more so than desktop computers, mobile devices will become the devices of choice for consumers who are looking to place orders online.

Mr. Kelly is more specific about the advances that he believes will overtake e-commerce, pointing out impact that augmented reality (AR) could have on people’s online shopping experiences. He says that “it’s like buying glasses online where you can load a picture of yourself and with your own face can try on glasses” and “you can load a picture of yourself and dress yourself on what you are going to buy with swipe right/left to see on you what things are going to look like.” These are both changes that would, without a doubt, make the online shopping experience more attractive to consumers who have stuck to in-person shopping because they enjoy trying things on before they make a purchase.

In addition to AR, Mr. Kelly also emphasizes ongoing growth in targeted marketing and omnichannel. Regarding targeted marketing, he says that all platforms will adopt a more personalized approach to the results and pages that they display to users, and regarding omnichannel, he says that more metro areas will see new brick-and-mortar locations opening, catering to the top-spending shoppers who make significant purchases both online and in person.

The elephant in the room, of course, is the largest retailer in the world: Amazon. According to FTI Consulting, Amazon will have achieved a 50% market share by 2023—up from just under 40% as of 2018 [6]. Although e-commerce is growing in general and that should benefit all retail e-commerce firms, Amazon’s upward trend is a certainty as well. To respond to both of these trends effectively, firms will need both strong culture, strong leadership, and a willingness to continue to examine them both and make changes as necessary.

Conclusion

The reality of e-commerce is change, which is also the only constant in the market. The COVID-19 crisis has created a uniquely challenging situation, but it is only one iteration of the constant challenge that all e-commerce firms should expect. Throughout this crisis and during all other, smaller crises in the future, the right leaders will be able to guide their firms forward. By interpreting big data and analyzing trends, these leaders will continue to successfully integrate e-commerce into our day-to-day lives.

REFERENCES

1. http://www.census.gov/retail/mrts/www/data/pdf/ec_current.pdf

2. http://www.statista.com/statistics/379046/worldwide-retail-e-commerce-sales/

3. http://www.fastcompany.com/90382936/amazons-hunger-for-grocery-stores-goes-beyond-whole-foods

4. http://blog.contactpigeon.com/tesco-case-study/

5. http://www.businessinsider.com/ikeas-online-sales-surge-43-2019-9

6. http://www.essentialretail.com/interviews/maplins-online-relaunch/

7. http://www.fticonsulting.com/insights/articles/2018-us-online-retail-forecast